I’ve been otherwise occupied this month, so I’ve only had a chance to keep an intermittent eye on the Stimulus Plan and its development. One of the things that I was a bit disappointed to find is that despite the copious amounts back-and-forth prattle coverage and the much better ongoing discussions in the economic/biz blogs that I follow, that I couldn’t find a really good single page/resource for describing in simple, understandable terms what’s happening to the economy and why economic stimulus is needed and how the plan will help.

One of the first places I went to was WhiteHouse.gov and the complete failure in communicating and selling the stimulus plan on there, especially coming from my experience on the campaign, was a (surprising) failure on the part of the Obama administration. And, while I think that this past week has been much better with the President’s recent WP op-ed and tonight’s press conference (video), I think that having a good, concise one-pager would still be an enormous benefit.

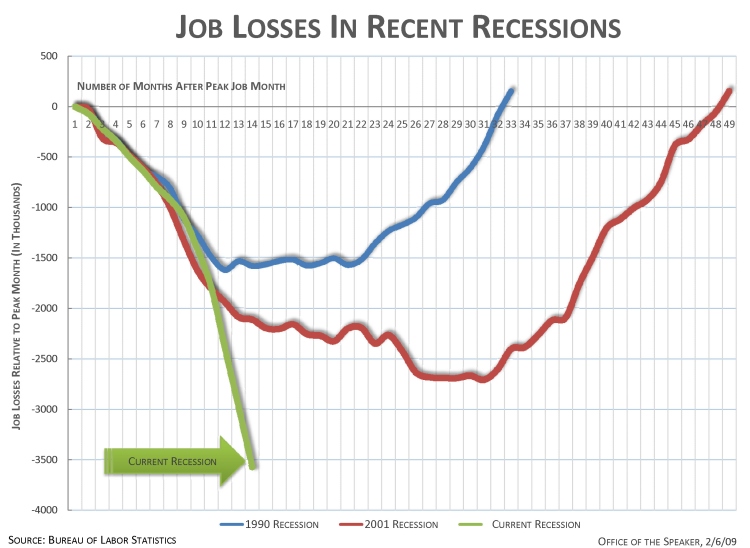

It’s one thing to talk about a full-blown crisis, but an image like this (posted Friday on Nancy Pelosi’s blog) makes things much clearer:

(Here’s a version with job losses from all post-WWII recessions, although I don’t know if they’re using consistent measurements)

Also, from a understanding macro-economics or fractional banking perspective, I think that there’s a pretty big gap in terms of understanding what’s going on (about 3min in to hear about the details of the bank run):

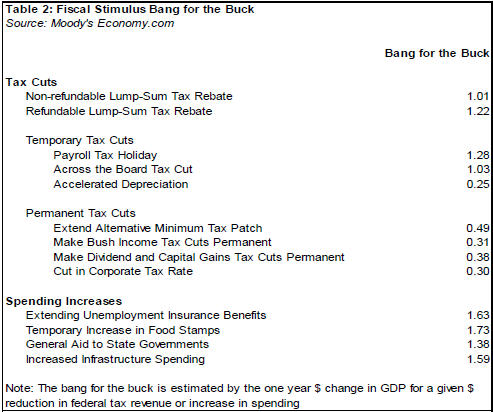

For me, the things I’d be most interested in are the economic projections (job losses? GDP shortfall?) and accessible breakdowns of the stimulus plan effects (hint: a 100pg PDF is not the ideal format), the effects of the infrastructure investments, and comparisons of tax cuts vs direct spending:

Lastly and perhaps most importantly I think is that spotlight on the economy needs to force us to talk about and address the huge structural problems that we’ve been ignoring – sustainability of growth, consumption, income inequality, etc. Here’s a video of Robert Reich discussing some of this:

While I’m disappointed that neither the MSM nor the Stimulus Plan backers have done something like this, it’s occurred to that this is the perfect sort of project some good designers to tackle in conjunction w/ either some of the economist bloggers that have covering this stuff or some of the civic groups out there. (Just saying.)

(FWIW, I recently started reading Krugman‘s The Return of Depression Economics and the Crisis of 2008 which has been pretty interesting so far. For those looking for a better idea of how our money and our economy works, Chris Martenson’s Crash Course is good (and depressing) start. The Wikipedia entry on the Economy of the United States is also a good place to start surfing.)